Overcoming the Labor Shortage

Seven hundred and fifty new graduates joined Hoshino Resorts in the spring of 2024, and after undergoing orientation and training, they are now in the process of becoming familiar with the work at their assigned facilities. The plan is to have them acquire the minimum necessary operational knowledge and skills by mid-July before the summer vacation, at which point I believe Hoshino Resorts will overcome the labor shortage.

This was not achieved simply by strengthening recruitment; it was largely the result of an operational optimization project that began in the spring of 2023. Efforts were made to determine newly required labor hours by organizing—with evidence—what work should be eliminated, what work should be kept, and what new work should be added. No matter how minor a task may be, changing just one thing slightly can affect six factors: customer satisfaction, profitability, brand power, the short-term ability to attract customers, the physical burden on staff, and staff mentality. I believe that balancing these six factors at a high level is good management and the optimal nature of operations.

I resumed visiting our facilities around Japan in the spring of 2023 following the end of the COVID pandemic. Participating in the activities of the operational optimization project, I gained insights into new changes through frank discussions with staff. Doing so also made me understand that the operational optimization project shall be an opportunity to realize change and that it should continue for some time. After completing the milestones of the first phase, we implemented the correct process of determining the current/newly required working hours and then secure an appropriate number of personnel. As a result, we were able to see a path forward to overcoming the labor shortage.

The labor shortage in Japan's tourism industry is an opportunity to improve working environments in the industry as well. Working environments, including salaries, have long been an issue for welcoming and nurturing talented people in this industry. And during labor shortages, investing in improvements is more likely to be profitable. From a macro perspective, creating work environments sought by the market will lead to maximize hotel RevPAR (revenue per available room). This naturally causes higher costs, which must be compensated for through productivity gains. As productivity in Japan's tourism industry is low compared to many other industries in Japan, and even low compared to the global tourism industry, there is plenty of room for growth. The fact that the unit price per guest room is rising in line with increased demand for tourist lodging is also a plus, but true productivity gains will come from optimizing operations. I will continue these activities in 2024.

Sensing the Evolution of the OMO Brand

The OMO brand was launched in the spring of 2018, the same year OMO7 Asahikawa opened. Two years later, in the spring of 2020, the COVID pandemic hit and branding activities were temporarily suspended. They were only able to resume in earnest in 2023, meaning that they have now been in operation for three years. Also, having found new opportunities to be entrusted with the management of urban hotels during COVID pandemic, the number of OMO facilities now stands at 17.

Hoshino Resorts' entry into the urban hotel market follows a differentiation strategy. While many urban hotels focus on business travelers, the OMO brand has a heavy emphasis on the urban tourism market.

Our 2014 market survey revealed three key points:

- 1. The non-business urban tourism market comprises a large segment.

- 2. In the urban tourism market, non-business travelers stay in hotels designed with tangible and intangible factors for business travelers, and these travelers do not feel that the services are well suited to their needs.

- 3. The hotel stay is not an element that increases the excitement of the entire sightseeing trip.

When Hoshino Resorts entered the urban hotel market, it targeted the urban tourism market and set a strategy to create hotels that perfectly fit the needs of that market. The result was the concept of “Get down with the local rhythm.”

OMO Rangers are responsible for embodying services in line with this concept. Defining the area within 500 steps of the hotel as our neighborhood, and the OMO Rangers' role is to build relationships with cafes, restaurants, shops, supermarkets, and other places that are part of the local culture, and to create content that helps guests enjoy the city.

Through neighborhood maps placed in the hotels, various classes held within the hotels, and tours of the neighborhoods, the OMO Rangers provide information and experiences in a timely manner during guests' stays. The creativity of the OMO Rangers as tourism personnel is the essence of the OMO brand's competitiveness, and we see these as activities that involve trade-offs in order to become a hotel that is difficult to imitate.

When urban hotels are thought of as simply places for business travelers to sleep, proximity to train stations becomes important. But when they are thought of as bases for services to enjoy the unique culture of the city, the definition of a good hotel location changes, as a prime location is where local shops are found. Recently, we have noticed customers here and there saying that when they stay at OMO hotels, they make a point of going without making any plans. This really shows us how well the OMO brand has taken root.

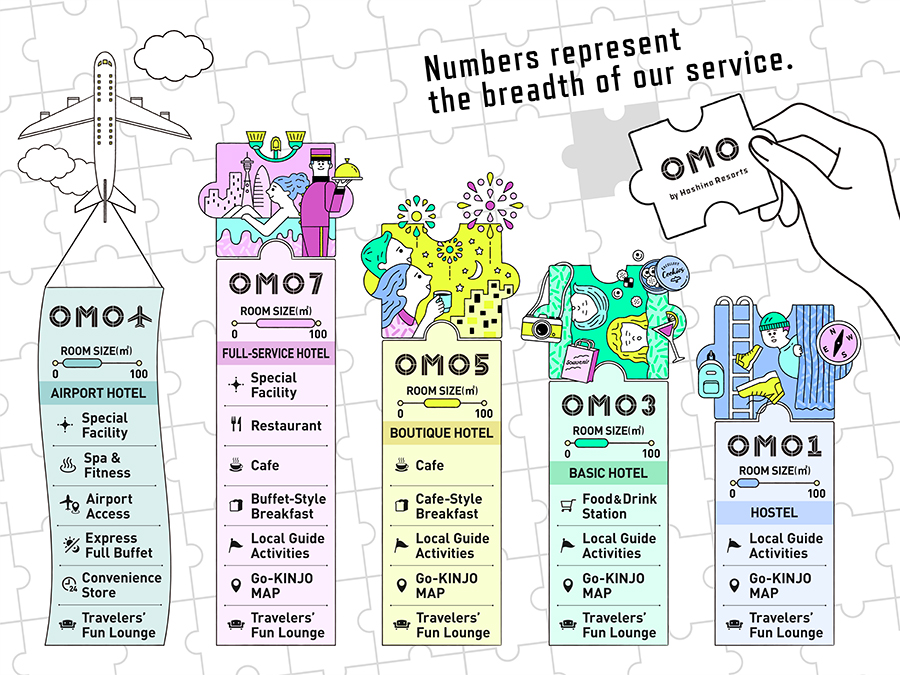

Beyond the original concept of neighborhoods, we are also making progress on collaborations with cities' major tourist attractions. For example, the Asahiyama Zoo Lecture, created in collaboration with Asahiyama Zoo at OMO7 Asahikawa, is popular and has become a reason for people to choose the OMO brand within the city of Asahikawa. OMO7 Osaka is home to the first Universal Studios Japan's official OMO Rangers, created in cooperation with Universal Studios Japan. Others include OMO3 Kyoto Toji and To-ji Temple, OMO5 Otaru and the Otaru Canal Boat, and OMO5 Otaru and LeTAO. At OMO5 Kumamoto, the popular local character Kumamon now joins lectures every Friday. In this way, we have been able to create synergy by managing connections with each city's major tourist attractions. The brand promise is to deliver hotels that excite urban tourists, so we believe that there should be a wide range of tangible and intangible elements within the OMO brand. However, as customers need to know in advance the grade of available tangible and intangible elements, we introduced a system that expresses this in numbers, a completely new method in the hotel industry (see the figure below).

This numbering system accurately conveys the information that a guest can expect from each hotel. The common element across all OMO brand hotels is that the OMO Rangers operate at the same level everywhere, working with their neighbors to create special experiences for guests. Needless to say, this numbering system allows the brand to expand more quickly and enjoy economies of scale in attracting customers. Customer satisfaction is the value provided in relation to expectations. Looking at the changes in our ongoing customer satisfaction surveys, we have been able to obtain the same level of satisfaction from OMO3 to OMO7, and we feel that the system is beginning to penetrate the customer base.

We have been patiently working to introduce the new concept of the OMO brand. Now, in 2024, we are seeing progress. First is the high percentage of urban tourists among our guests. 90% or more of our guests are tourists, which is right on target. Second, the market segment that responds to the OMO concept is of course inbound tourists but also primarily the domestic Japanese market. This increases the potential for expansion in appealing regional cities where inbound visitors do not yet visit. In Kochi Prefecture, which still ranks low in terms of inbound visitors by prefecture, OMO7 Kochi—which opened on May 16, 2024—believes that it will be able to fill the gap with the domestic market in the short term and then increase inbound tourism over time. Third, it is becoming easier to collaborate with neighbors who operate businesses in areas around our hotels. The newly opened OMO5 Tokyo Gotanda is working with a record number of neighborhood businesses. The OMO brand is penetrating the market, and at the same time, the professionalism of the OMO Ranger operations is increasing.

Given that entering the urban hotel market—crowded as it is with hotels having similar concepts—is not an easy task, OMO chose to focus on the urban tourism market as its main target right from the beginning and actively developing distinctive services.

Although it will take a certain amount of time to penetrate the market due to the unprecedented and highly specific nature of our work, we feel that we are connecting with a target market that responds to our OMO concept at a time when the COVID pandemic has ended and the tourism market is recovering. Going forward, we will continue to create a firm, truly unique brand position while staying true to our original strategy.

- (Note)

- For the properties mentioned in this document that are not owned by HRR, there are currently no specific plans for HRR to acquire them, and there is no guarantee that they will be acquired by HRR in the future.