Climate Change Initiatives

Recognition and Awareness of Climate Change

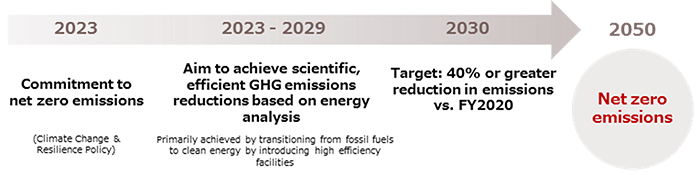

Hoshino Resorts REIT, Inc. (hereinafter, “HRR”) and its asset management company, Hoshino Resort Asset Management Co., Ltd. (hereinafter, “the Asset Management Company”) recognize that the progression of climate change is an important issue that can bring about dramatic changes to the natural environment of the Earth, the social structure of the world, and the activities of humans and other living things. It can also have a significant impact on the entire business of HRR and the Asset Management Company. For this reason, HRR believes that it is essential to reduce the impact of climate change on corporate activities in order to conduct sustainable corporate activities in the long term. With this understanding, we have developed the following roadmap to net zero in 2050 and plan to reduce GHG emissions by at least 40% (compared with the 2020 level) by 2030.

Ever since the Industrial Revolution in the latter half of the 18th century, humans have been consuming large amounts of fossil fuels such as coal and oil, and developing artificial fertilizers. As a result, greenhouse gases such as carbon dioxide (CO2), which have an effect of preventing heat from being released into space, have increased significantly in the atmosphere, causing not only a rise in temperature but also various impacts on the global climate. It is said that it will take a long time before we reach a period of invention and evolution of great technologies that can serve as game changers in countering changes in the vast environment of the Earth.

Until such technologies are developed, the course of action for the Asset Management Company with regard to climate change is to contribute to society by not only to reduce GHG emissions scientifically and efficiently, but also working to reduce food losses, revitalize regional economies and maintain ecosystems to help recover the entire global carbon cycle to an appropriate state.

Roadmap for achieving net zero emissions

Announcement of Support for TCFD Recommendations

In November 2021, the Asset Management Company declared its support for the recommendations (TCFD Recommendations) made by the Task Force on Climate-related Financial Disclosures (TCFD), which was established by the Financial Stability Board (FSB) to examine how companies and financial institutions should disclose climate-related information. The Asset Management Company also joined the TCFD Consortium, a forum for discussions by supporting companies and financial institutions in Japan.

Governance System for Addressing Climate Change

The Asset Management Company has established an ESG Committee (hereinafter, "the Committee"). Particularly in addressing climate change issues, we have formulated a "Climate Change Resilience Policy" and appointed the President & CEO as the person with the ultimate responsibility and the Chief Sustainability Officer (CSO) as the person responsible for the execution to lead our initiatives in dealing with climate-change-related issues.

ESG Basic Policy (policy, management structure, and environmental initiatives)

Governance initiatives (risk management)

Implementation of Scenario Analysis

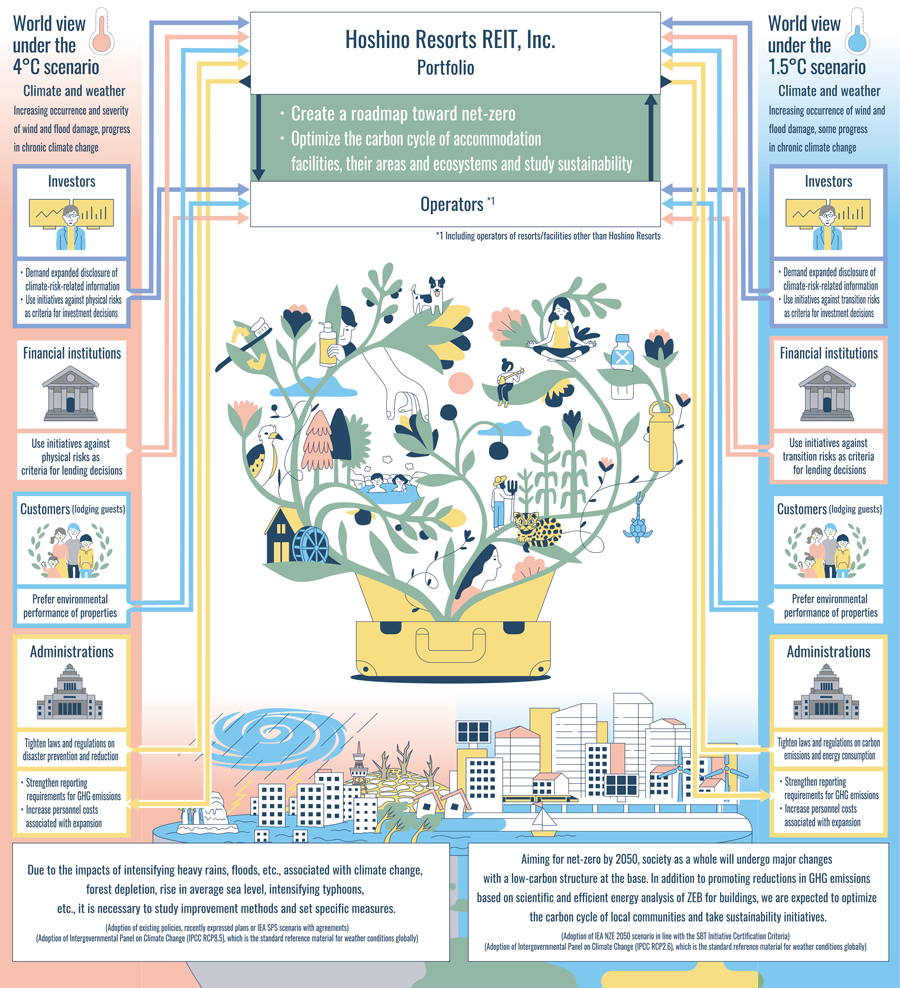

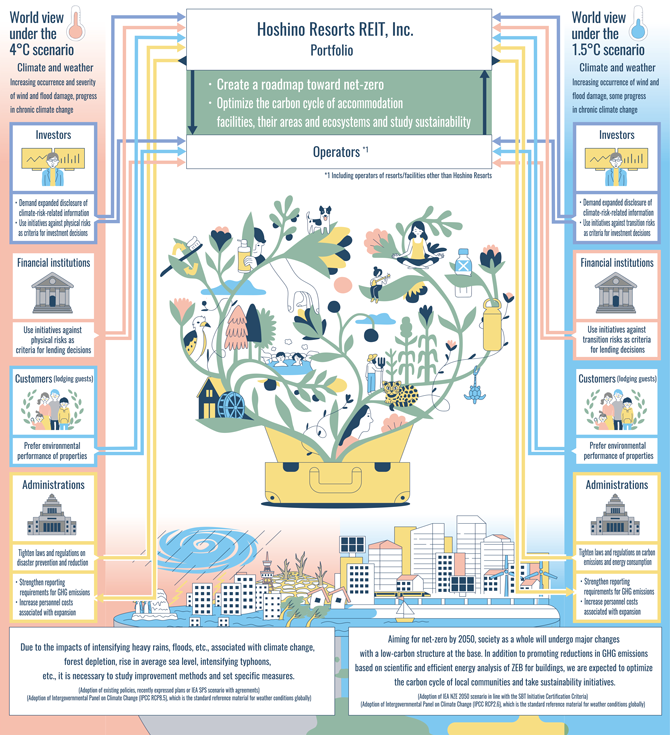

The Asset Management Company conducted a scenario analysis on the following two world views in order to identify the risks and opportunities for HRR pertaining to climate change and examine the impact of climate change on its business.

Verification of Financial Impact Based on Scenario Analysis

Furthermore, based on the scenario analysis, the Asset Management Company specified the risks and opportunities that could affect the business of HRR, and analyzed and evaluated the likelihood of occurrence of such risks and opportunities, their financial impact, and the measures to take against specified events as follows. We also examined the magnitude of the financial impact of risks and opportunities for each of the above scenarios for global warming of 4°C and 1.5°C. Medium-term (2030) and long-term (2050) projections are set for each scenario. The table below provides an overview.

Concept of financial impact (medium and high): Qualitative analysis is performed to evaluate the relative degree of impact.

Scenario Analysis Table

| Financial impact | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 4℃ scenario | 1.5℃ scenario | ||||||||

| Risks and opportunities | Financial impact | Risk management, countermeasures and initiatives |

Medium term |

Long term |

Medium term |

Long term |

|||

| Transition risks and opportunities | Policy and law | Increased taxation on GHG emissions as a result of introduction of carbon tax | Risks | Increased tax burden on GHG emissions of properties, causing earnings to decline | Obtaining opinions from relevant financial institutions and introducing or replacing with more efficient energy-saving facilities | Low | Low | Medium | Medium |

| Stricter emission reporting requirements under the Act on Rationalizing Energy Use | Risks | Higher operating expenses, such as payments to outside contractors to meet reporting requirements | Implementing renovations to put in place facilities with high energy-saving performance | Low | Low | Medium | Medium | ||

| Responding to laws and regulations overseas, especially in Europe | Risks | Delay in response, affecting investment decisions of foreign institutional investors and increasing the likelihood of being excluded from investment targets | Interviews with foreign lawyers, investors, etc. on necessary matters | Medium | Medium | Medium | Medium | ||

| Technology | Evolution and diffusion of renewable energy and energy-saving technologies | Risks | Higher costs for introducing new technologies to prevent facilities in properties from becoming technologically obsolete Depending on the technology selected, the evolution of innovative technology may result in further obsolescence, waste of money, and further increase in capital expenditures | Collaboration with business operators that develop and provide high-efficiency technologies and equipment | Low | Low | Medium | Medium | |

| Promoting acquisition of new buildings that accommodate clean energy and upgrading to the latest high-efficiency facilities | Opportunities | Cost reduction by improving environmental performance of properties and increasing energy efficiency | Medium | Medium | Medium | Medium | |||

| Market and reputation | Introduction of environmental performance standards for real estate appraisals | Risks | Decline in the fund's Net Asset Value (NAV) | Improving energy conservation performance, considering selling properties, improving the green building certification ratio, and promoting visualization of current status | Low | Low | Medium | Medium | |

| Higher water and utility costs (including renewable energy from external sources) | Risks | Increase in operating expenses | Water: Grasping the use of tap water, grey water, and sewage water Energy: For repairs, choosing energy efficient options and changing the operation method (considering microgrids, etc.) | Medium | Medium | Low | Low | ||

| Changes in demand from tenants and lodging guests (selecting properties that are more resilient to climate change or avoiding properties that are not) | Risks | possibility of a decrease in the number of lodging guests, causing revenues to decline Making environmentally friendly architecture a prerequisite for the purchase of new properties can narrow the market and possibly lead to an increase in cash spent for acquiring properties and in borrowings | Field survey of current status and projections and examination for the future, Considering acquiring properties with high potential for climate change countermeasures, Establishment of criteria for avoidance, such as a stranded asset checklist, etc. at the time of new acquisition | Low | Low | Medium | Medium | ||

| Growing preference for architecture with high environmental performance and changes in the procurement environment for materials and human resources | Risks | Shortage of materials with high environmental performance and surge in labor costs due to concentration of construction work | Medium- and long-term planning and prior engagement with stakeholders | Low | Low | Medium | Medium | ||

| Decline in brand value from investors | Risks | Difficulty in raising funds due to a deteriorating business environment | Disclosure of medium- to long-term environmental plan based on the certification system, ESG initiatives and analysis of current status Diversification (expansion) of investors | Low | Low | Medium | Medium | ||

| Decreased trust from tenants and lodging guests | Risks | Not being selected by lodging guests, leading to lower operating profit | Action plan for environmental management based on agreement on direction after training and discussions for tenants and owners Strengthening partnerships with tenants | Low | Low | Medium | Medium | ||

| Continuous provision of rental properties tailored to changes in tenant preferences (rent-linked properties) Unearthing new customer segments | Opportunities | Increased revenues due to rent increases and improved acquisition and securing of lodging guests | Improving the environmental performance of the portfolio in a timely manner to improve the performance of properties | Low | Medium | Low | Medium | ||

| Unearthing new investor segments | Opportunities | Use of green bonds and sustainability finance Increase in the size of financing and decrease in procurement costs as a result of responding to and appealing to investors who place importance on environmental issues | Investigation of various frameworks | Low | Medium | Low | Medium | ||

| Promotion of Creating Shared Value (CSV) | Opportunities | Improved environmental performance of properties owned Discovering a unique approach to CSV Improved competitiveness of properties More investors, bigger areas | Conducting own environmental performance research and studying with operators while responding to the Green Building Certification over the medium to long term | Medium | Medium | Medium | Medium | ||

| Physical risks and opportunities | Acute | Damage to properties due to strong wind or inundation caused by typhoons and torrential rains | Risks | Increase in repair costs and insurance premiums, lower occupancy rate due to temporary closures, decrease in customers due to disruptions in transportation systems | portfolio diversification | High | High | Medium | Medium |

| Occurrence of a major earthquake (Tokyo metropolitan area epicenter, Nankai Trough) or volcanic eruption (Mt. Fuji, Mt. Asama) | Risks | Increase in repair costs and insurance premiums, lower occupancy rate due to temporary closures, decrease in customers due to disruptions in transportation systems Loss of a building | Planning for enhancing resilience after portfolio diversification and gathering the necessary data to prevent damage | High | High | High | High | ||

| Chronic | Inundation of properties located in low-altitude areas due to a rise in sea level | Risks | Incurring costs for large-scale renovation (floor raising) and decline in customers | Implementation of risk assessment | Medium | Medium | Medium | Medium | |

| Increase in the frequency of disasters (floods, earthquakes, etc.) and greater severity of typhoons | Risks | Increase in maintenance costs, such as repair costs and insurance premiums, and decrease in land prices of properties owned | Installation of facilities capable of responding to disasters and reinforcement of evacuation facilities and routes | Medium | Medium | Medium | Medium | ||

| Higher assessments from lodging guests and improvement of occupancy rate due to the high performance of environmentally friendly architecture | Opportunities | Increase in rent due to improved earnings | Formulating plans for high-performance environmental architecture | Medium | Medium | Medium | Medium | ||

| Contribution to reducing carbon dioxide and maintaining landscapes through conserving and co-existing with the natural environment (forests, oceans and rivers) of resorts and areas where properties are located | Opportunities | Revitalization of local economies by revitalizing local communities and nature Improved corporate image Being selected by lodging guests adds to hotel revenues Adoption of J-Credit, etc. | Commencement of discussions with operators | Medium | Medium | Medium | Medium | ||

| Conversion to unique environmentally friendly architecture and resorts | Opportunities | Maintaining and improving earnings by increasing the competitiveness of properties, improving property values, and maintaining an advantage in the property acquisition environment | Working together with a team of technical and design experts on properties to create the future of accommodation facilities and local areas, at the same time, studying the sustainability of facilities by considering the carbon cycle from the ecosystem | Medium | Medium | Medium | Medium | ||

| 1.5°C Scenario | (Transition risk) IEA NZE 2050 scenario | (Physical risk) IPCC RCP 2.6 scenario |

| 4°C Scenario | (Transition risk) IEA SPS scenario | (Physical risk) IPCC RCP 8.5 scenario |

- IEA: International Energy Agency

- IPCC: Intergovernmental Panel on Climate Change

Risks in the Hotel Market/Real Estate Industry and Addressing/Managing Risks

1. Transition risks

There are concerns that the strengthening of policies and regulations to counter climate change will affect the real estate business in various aspects, such as GHG emission regulations, regulations on energy-saving performance of buildings, and the introduction of a carbon tax, while efforts are made toward achieving net zero by 2050. In addition, there is a possibility that we may be expected to promptly respond to the requests and investment decisions of institutional investors in Europe and other environmentally advanced countries.

In the tourism and accommodation businesses, given the growing awareness of guests about the environment, it is necessary to make further efforts for the benefit of local environments and economic circulation to become the hotel of choice in the medium to long term. As such, the tourism market is facing a major turning point.

The Asset Management Company will address transition risks associated with climate change by taking various measures to reduce GHG emissions, such as promoting energy conservation of buildings to reduce GHG emissions and improve energy efficiency and refining the buildings after meeting the conditions for earthquake resistance, etc. rather than rebuilding. At the same time, we will work to optimize the carbon cycle through protecting the primary sectors that play a role in maintaining the local culture and conserving the natural environment.

Specific initiatives are as follows.

Initiatives to reduce GHG emissions in the tourism business

When repairing and renovating buildings, in addition to constantly examining ways to reduce GHGs as described above, we also promote "3R (Reuse, Reduce, and Recycle)" in operating hotels and Japanese ryokans, use pump bottles for amenities, stop placing plastic (polyethylene terephthalate or PET) bottles of mineral water and other drinks in guest rooms and take other steps, while cooperating with operators to ensure that accommodation facilities continue to offer comfortable stays for guests. Furthermore, in order to conserve local areas in harmony with the environment of accommodation facilities, we are considering establishing a system that enables us to conduct environmental conservation activities that take into account the local production and consumption of foodstuffs and the carbon cycle of the sea, rivers, forests, etc. to also reduce supply chain emissions (Note).

- This refers to the total amount of emissions including not only the emissions of the business operator itself but also all other emissions related to its business activities. In other words, it refers to the amount of greenhouse gas emissions generated from the entire business process from raw material procurement to manufacturing, distribution, sales, and disposal.

Supply chain emissions = Scope 1 emissions + Scope 2 emissions + Scope 3 emissions

https://www.env.go.jp/earth/ondanka/supply_chain/gvc/en/supply_chain.html

2. Physical risks

Japan has four distinct seasons where, given its geographical location, typhoons and heavy rain occur from summer to autumn and snow accumulates in winter. These seasonal climatic characteristics are the source of Japanese culture that has cultivated food and events for the tourism industry. However, because of climate change, these seasonal climatic characteristics are becoming harsh and may even cause a disaster. Moreover, now that projections indicate the possibility of a Nankai Trough earthquake or other major earthquakes occurring in the not-too-distant future, having a resilience system is becoming very important in terms of business continuity and saving lives. In particular, as natural disasters become more frequent and severe, financial impacts, such as increased repair costs and higher insurance premiums, can become an issue as a physical risk. The Asset Management Company is preparing measures to enhance resilience in order to minimize damage to its properties caused by disasters and to reduce the risk of the profitability of its portfolio being impaired. Specifically, we will examine the resilience function and recoverability based on the current risk status of each property in the portfolio, take into account the magnitude of impact on the financial standing of HRR and the importance of each property in the portfolio among other factors, and determine the order of priority in line with the scenario analysis to implement disciplined plans.