Sustainable Equity

Overview of the Sustainable Equity

Hoshino Resorts REIT, Inc. (HRR) and Hoshino Resort Asset Management Co., Ltd. (Asset Management Company) believe that it is important to maximize investor value through ESG-conscious investment and asset management to improve the sustainability of HRR. Based on this belief, HRR has formulated a framework and raised funds through sustainable equity as part of its sustainability efforts.

It will not stop with fundraising through sustainable equity, etc. but will continue to contribute to the future through distinctive investment and asset management as it achieves its goal of creating shared value (CSV) aimed at solving social issues in accordance with its sustainability policy.

Sustainable equity is a collective term for Sustainability Equity and Green Equity. Please see each tab for details.

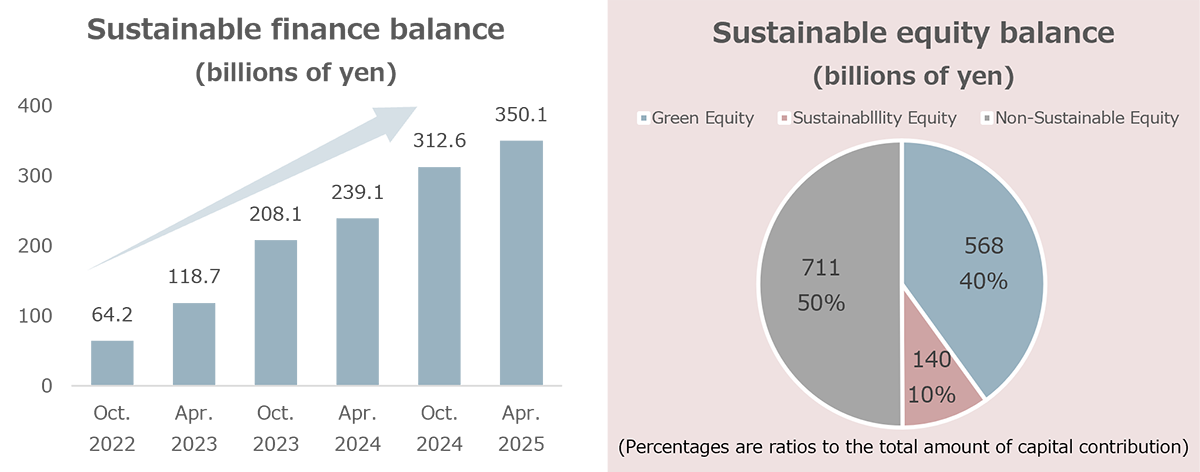

Overview of Sustainable Equity Fundraising (As of November 28, 2025)

- The “Sustainable Finance Balance” includes green and sustainability finance executed under the former Green and Sustainability Finance Framework (prior to the update in September 2024).

- The “Green Equity Balance” and the “Sustainable Equity Balance” are calculated based on the criteria in effect at the time the relevant environmental certifications were obtained, regardless of any subsequent changes to the certification systems.