Governance

HRR organization

HRR shall have at least one Executive Director and at least two Supervisory Directors (the number of Supervisory Directors must be equal to or larger than the number of Executive Director(s) plus one). See Directors for details on the status of Directors.

- General Meeting of Unitholders

- Executive Director, Supervisory Directors, and the Board of Directors

- Independent Auditor

- Asset Management Company, Asset Custodian, and General Service Administrator

- Organization, Personnel and Procedures of Supervision through Internal Control and by Supervisory Directors

- Internal Control and Supervision through Supervisory Directors and Mutual Collaboration with Accounting Auditor

- Development Status of HRR’s System for Managing Related Entities

For details on the above refer to 【Organization of HRR】 Matters Concerning Governance of HRR (PDF)

Asset Management structure

Management of HRR’s assets is entrusted to Hoshino Resort Asset Management Co., Ltd., the Asset Management Company, which performs its assignments based on the asset management agreement concluded with HRR under the following organizational structure.

(Organizational structure of the Asset Management Company)

【Structure of Asset Management Company】

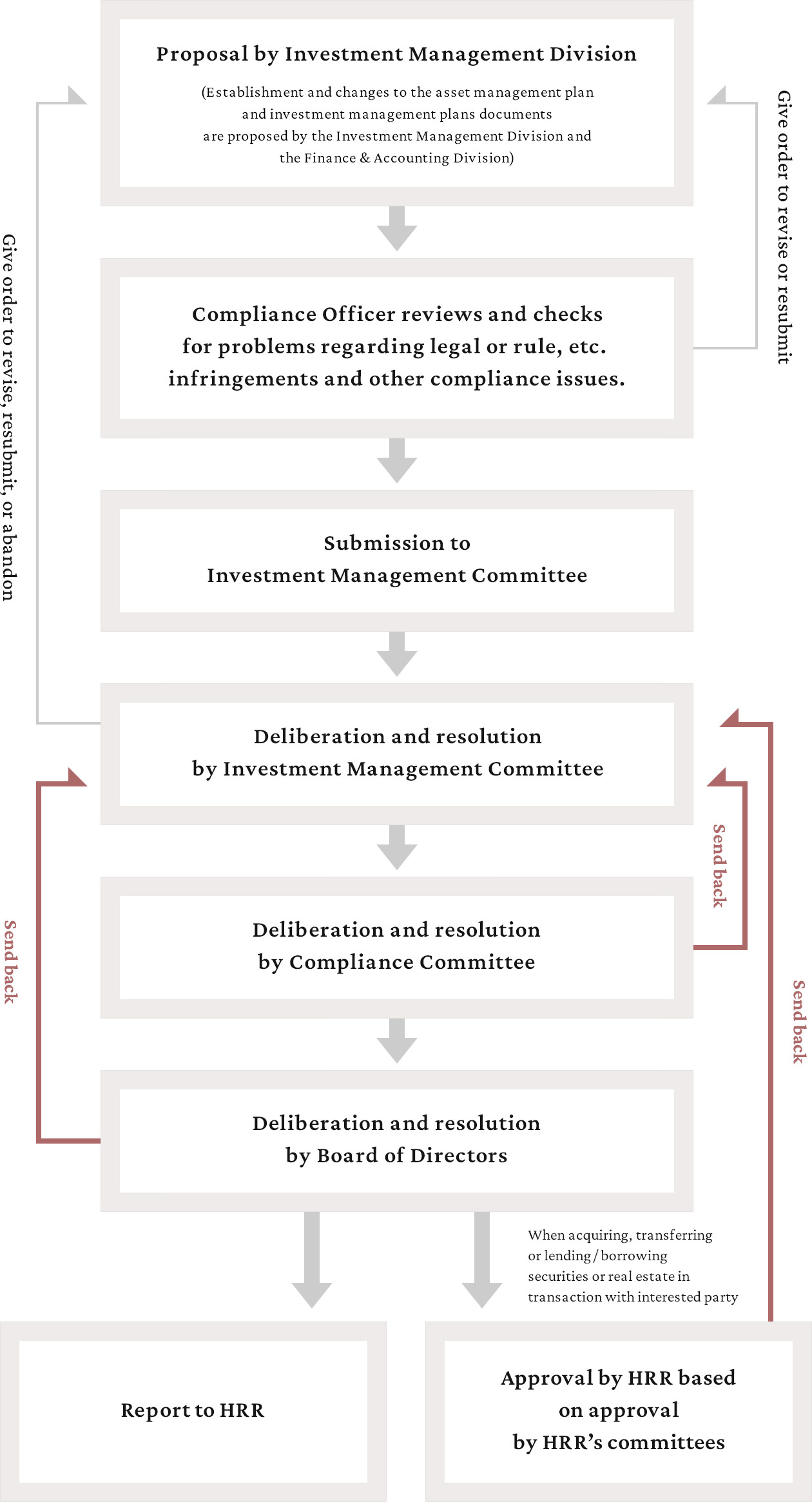

HRR’s decision flow chart for investment management decisions

For details see 【HRR’s asset management structure】 (PDF).

Internal control

Hoshino Resorts REIT, Inc. (“HRR”), and Hoshino Resort Asset Management Co., Ltd. (the “Asset Management Company”), to which HRR entrusts the management of its assets, recognize the significance of HRR’s asset management being the act of managing the assets of HRR’s unitholders, and establish a management structure appropriate for compliance-focused business management.

HRR stipulates in its Rules of the Board of Directors that Meetings of the Board of Directors shall be held at least once every three months. HRR’s Board of Directors meetings shall be attended by the Executive Director and Supervisory Directors. In the presence of the Asset Management Company, the Executive Director is to report on the status of his or her job execution as well as on the business execution status of the Asset Management Company, General Service Administrator, and Asset Custodian, thereby ensuring an internal control system in which control is exercised through the Board of Directors meeting. Reporting of the Executive Director’s job execution status and of the business execution status of the Asset Management Company, General Service Administrator, and Asset Custodian shall be carried out at least once every three months. Currently, one lawyer and one certified accountant for a total of two individuals are appointed HRR’s Supervisory Directors, each of whom build on their past experience and expertise to provide multifaceted supervision of the Executive Director’s job execution.

The Asset Management Company considers compliance to be a key priority, having established Compliance Rules, a Compliance Manual, and a Compliance Program to build frameworks and put them into practice. We believe compliance goes beyond mere adherence to laws and regulations. To us, compliance means each individual officer and employee acting with awareness of ethics and social norms to fulfill our corporate social responsibility.

The Asset Management Company stipulates the following in the basic policies of its Compliance Rules.

- The Asset Management Company, fully recognizing that failure to ensure compliance may shake the foundations of our business, considers thorough compliance to be a key priority in our business management.

- The Asset Management Company recognizes our responsibility as a financial instruments business to ensure our business value is realized to meet societal expectations. We are committed to proactive and continuous engagement in compliance to enhance the value of our business, both in quality and in quantity.

- By our compliance actions described in (b) above, the Asset Management Company aims to contribute to economic and social prosperity, improve our estimation in the eyes of investors, and gain the solid trust of society at large.

For details see 【Systems for managing investment risk】 (PDF).

Corporate Ethics

Conduct of Audits of All Business

Responsibilities Regarding Business Ethics and Corporate Corruption for Management

HRR’s Board of Directors meetings shall be attended by the Executive Director and Supervisory Directors. In the presence of the Asset Management Company, the Executive Director is to report on the status of his or her job execution as well as on the business execution status of the Asset Management Company, General Service Administrator, and Asset Custodian, thereby ensuring an internal control system in which control is exercised through the Board of Directors meeting.

As a decision-making body for policies and related matters regarding the promotion of compliance, the Board of Directors of the Asset Management Company takes responsibility and supervises the proper execution of the asset management business entrusted by HRR having established Compliance Rules, a Compliance Manual, and a Compliance Program to build compliance frameworks and put them into practice.

Scope of Employees Participating in Training Related to Ethical Standards

For details, please refer to "Initiatives to develop human resources"

Anti-bribery and Anti-corruption Policy

Provision of Protection for Whistleblowers

- Whistleblowers are not to be subject to dismissal or any disadvantageous treatment for reason of reports or consultations.

- The Company must take appropriate measures, without deteriorating the working environment of whistleblowers, for reason of reports or consultations.

- Pursuant to work regulations, penalties may be imposed upon those who give disadvantageous treatment to or harass whistleblowers.