theme 1

Balancing Long-Term Perspectives and Investment Results

theme 2

Toward Sustainable Improvement of Unitholder Value

Strategic Empowerment Based on the Dividend Discount Model and a Future Growth Roadmap

Director and Chief Investment Officer

Etsuro Takahashi(left)

Director, General Manager of the Corporate Planning Division, and CFO

Takahiro Kabuki(right)

theme 1

Balancing Long-Term Perspectives and Investment Results

Profile

-

Director and Chief Investment Officer

Etsuro Takahashi

Joined Hoshino Resort Asset Management in 2019 after working on multiple mixed-use redevelopment and urban development projects for a domestic general developer. Since joining the company, involved in the acquisition, operation, and sale of hotels.

Introduction

In 2024, a total of 36.87 million foreign visitors traveled to Japan, driving consumption of 8.1257 trillion yen, both of which are significantly higher than previous years “Source: Japan National Tourism Organization Number of foreign visitors to Japan (annual estimate for 2024)”. In 2025, the momentum has continued unabated, with records continuing to be broken almost every month. Hotel occupancy rates have increased mainly in major cities, and business performance has shifted from a recovery phase to a growth phase. In particular, the unit cost of a room (average daily rate, or ADR) has risen, especially at hotels with high unit costs; the entire industry seems to have a strong tailwind at its back.

But at the same time, growing pains accompanying this rapid growth have become apparent in various places. Examples include friction with local residents due to overtourism, excessive expectations due to skyrocketing hotel prices, and a shortage of human resources and declining service quality. It is unlikely that the current boom will be sustainable if these issues are left unaddressed. In order for hotels to maintain their long-term competitiveness, they need to seriously address the issues behind their growth and implement strategic and balanced initiatives.

Steps to Solve Issues

Given these circumstances, Hoshino Resorts has been actively investing in its employees and work environments. The accommodation industry currently faces a chronic labor shortage, and the workloads of individual employees is increasing. While it is becoming increasingly difficult to secure and retain talented personnel, Hoshino Resorts is working to improve working conditions, such as by raising the starting salary for new graduates, and is also approaching the issue from the perspective of working styles, such as by establishing facilities that introduce a four-day work week system on a trial basis.

At first glance, a four-day work week may seem like an employee-first policy, with concerns that the number of staff required to operate facilities will increase and total personnel costs will rise. However, there are clear benefits for the company as well. Especially in rural areas, the hotel industry competes with local government offices and local factories of major manufacturers for human resources; providing easy working conditions and flexible work systems is a major differentiating factor in the course of recruiting personnel. In addition, a good work-life balance for employees has the potential to reduce turnover rates and lead to higher retention rates, reducing recruitment and training costs in the medium to long term. And by using their leisure time for self-improvement and community activities, employees can contribute diverse perspectives and experiences to their work. We expect this to have the secondary benefit of improving the quality of service we offer.

Separation of Ownership and Operation

In recent years, the hotel industry has seen the separation of ownership and operation. This is becoming the norm, with hotel operators focusing on planning and operating the hotel, while the ownership of the hotel real estate is managed by players specializing in asset management, such as real estate investment corporations and real estate funds. However, given this structure, there are cases where the viewpoints of the owner and the operator do not always agree. For short-term owners who want to limit the period of ownership and lock in profits by selling properties while their value is high, short-term profit maximization is more important than the sustainability and medium- to long-term profitability of the hotel.

While monetization through short-term real estate sales is possible, it is very difficult to generate profits on a continual basis through short-term sales; that it is like the idea of continuing to win through short-term stock trading. HRR therefore is committed to real estate management with a long-term perspective, and we manage our properties with the aim of determining whether property sales and attractive investments through CAPEX will contribute to maintaining and improving our competitiveness from a long-term perspective.

Immediate Action

Investing in employees and work environments is a crucial step in maintaining and improving the competitiveness of our facilities in the future. But at the same time, this investment was accompanied by a decline in immediate profitability, and rents paid also decreased compared to before the investment was made. The measures disclosed on March 18, April 18, and June 16 in 2025 were implemented after extensive discussions with sponsors in order to find ways to increase the income of HRR while incurring the necessary costs for the facilities.

The most important thing to note about these measures is that they aim to improve HRR's profitability without sacrificing measures that are necessary in the long term. For example, forcibly cutting other costs in response to rising labor costs (such as reducing the quality of amenities and furnishings) may improve profits in the short term, but doing so may lead to a decline in customer satisfaction and, ultimately, risk undermining facilities’ competitiveness. Instead, we have improved yields and rent levels by reviewing lease agreements and through asset replacement.

Finally

HRR has established a sustainable, long-term structure with Hoshino Resorts in a relationship that is built on coexistence and prosperity. Today’s talk was from the perspective of investing in human resources to prepare for immediate market risks. We will continue to strive to manage our investments in a way that balances a long-term perspective with investment results.

theme 2

Toward Sustainable Improvement of Unitholder ValueStrategic Empowerment Based on the Dividend Discount Model and a Future Growth Roadmap

Profile

-

Director, General Manager of the Corporate Planning Division, and CFO

Takahiro Kabuki

Joined this company in 2013 after working in corporate planning for a business company, where he was involved in finance and accounting and property acquisition. Left this company once in 2016 and rejoined in 2019, again after working in corporate planning for a business company. Currently engaged in disclosure, investor relations, corporate administration, and finance and accounting operations.

Measures to Increase Investment Unit Prices Based on Theory and Practice

Since our previous announcement of financial results in December 2024, the overall J-REIT market has been generally sluggish due to rising long-term interest rates. In addition, Hoshino Resorts prioritized investment in human resources in 2025 with the aim of strengthening its medium- to long-term competitiveness, which led to a temporary weakness in HRR’s investment unit price.

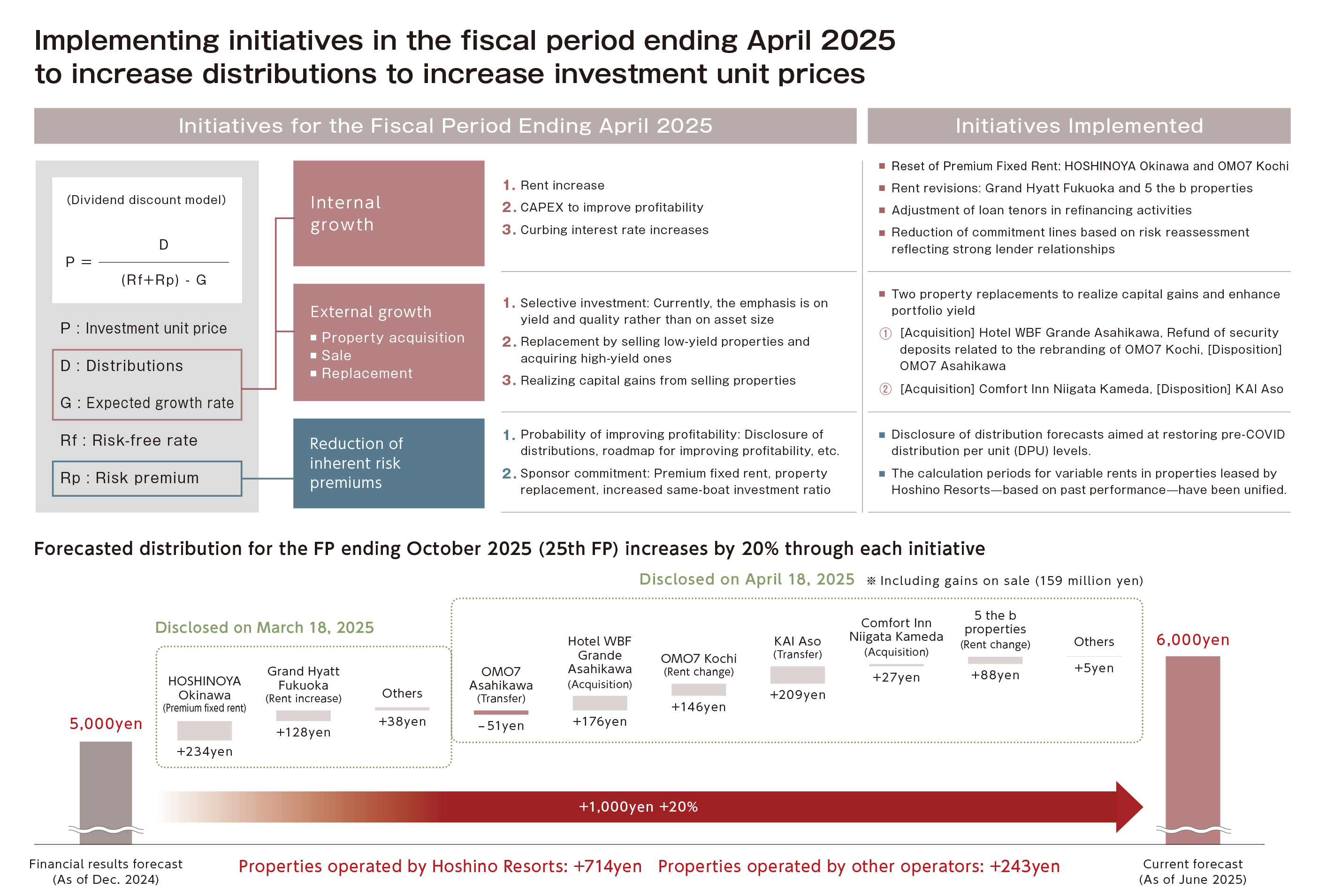

In order to overcome this situation, in 2025, as a short-term measure for investment unit prices, we implemented intensive measures on March 18, April 18, and June 16.

The dividend discount model provides a theoretical explanation for investment unit prices. Here, we factorized the components of investment unit prices based on this model to clarify issues and design measures. The specific measures include (1) generating of capital gains, (2) immediate internal growth (increases in rent), (3) improving portfolio yields through property replacement, and (4) improving the stability and transparency of distributions.

First, in order to increase distributions, we sold KAI Aso and posted a capital gain on the sale. On the other hand, simply selling the property would reduce the profitability of our entire portfolio, so we minimized the impact by acquiring Comfort Inn Niigata Kameda at a high yield.

Next, as an internal growth initiative, short-term, medium- and long-term rent increases were realized for five properties: HOSHINOYA Okinawa, Grand Hyatt Fukuoka, OMO7 Kochi, and the b. We also sold OMO7 Asahikawa, which had relatively low yields, and acquired Hotel WBF Grande Asahikawa, which has high yields, boosting the overall yield of our portfolio.

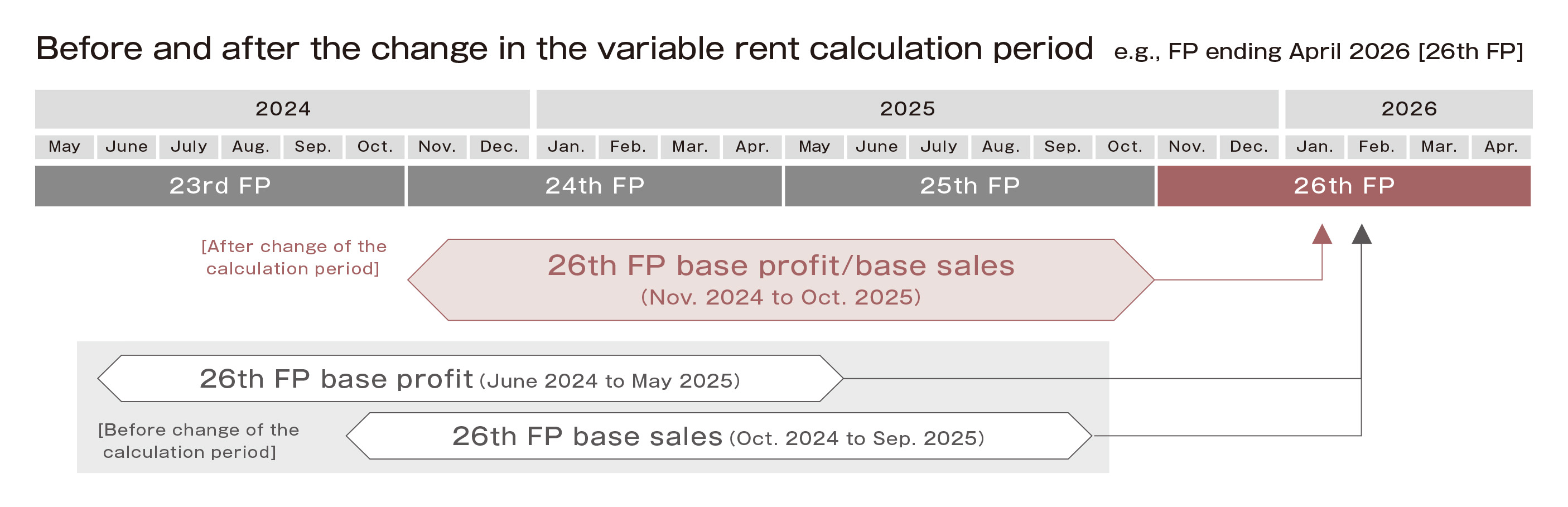

In addition, changes were made to rent structures to improve the transparency of distributions. Up until now, the calculation period for variable rent properties leased by Hoshino Resorts differed depending on whether they were sales-linked or profit-linked. These were unified as the year immediately preceding the relevant period.

This not only makes it easier for unitholders to understand also establishes a mechanism in which recent strong performance—such as that driven by the Expo 2025 in Osaka—can be reflected in dividend distributions more quickly.

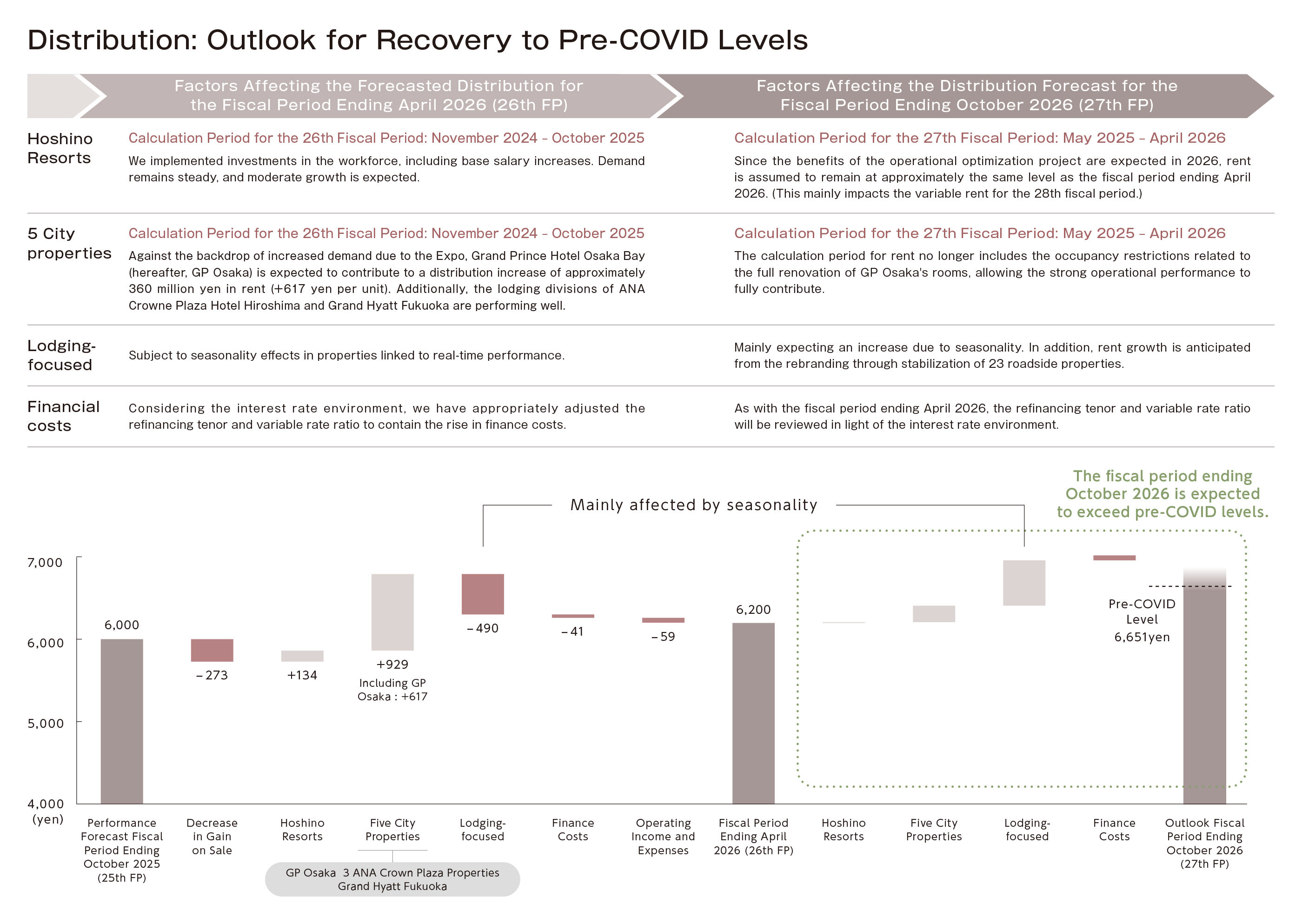

As a result of these measures, the distribution per unit for the fiscal period ending October 2025 (the 25th fiscal period) is projected to be 6,000 yen, up significantly (20.0%) from the initial 5,000 yen, followed by 6,200 yen for the fiscal period ending April 2026 (the 26th fiscal period), up 3.3% from the previous fiscal period. In response, investment unit prices also rose significantly (see slide below).

Distribution Growth Path and Earnings Drivers

That said, we are not satisfied with the current investment unit price or distributions. In order to further increase unitholder value, the most important task for the time being is to restore distributions to pre-COVID levels. To do so, we announced our distribution outlook and factors in the latest announcement of our financial results. For the fiscal period ending October 2026, the distribution per unit is expected to exceed the pre-COVID level of 6,651 yen (see slide below).

Beyond that, we aim to reach distributions at or above 7,000 yen. Hoshino Resorts boasts a high rate of inbound bookings, with over 60% of bookings made through its own websites. We hope to capitalize on this strength and further capture inbound demand going forward. In addition, Yoshiharu Hoshino, the representative of Hoshino Resorts, has been leading an operational optimization project for about two years, and the company will drastically review the personnel it deems necessary and aims to achieve highly profitable operations.

Meanwhile, even at properties outside Hoshino Resorts, the accommodation departments of the ANA Crowne Plaza Hiroshima and the Grand Hyatt Fukuoka are doing well thanks to the renovations carried out by HRR. We will continue to aim for further growth through effective renovations.

Unitholder Value Created Through Collaboration with Hoshino Resorts

Since its listing, HRR has achieved stable growth, supported by the operational capabilities of Hoshino Resorts. However, even companies that deliver strong results do not well all the time. It is undeniable that Hoshino Resorts' human resource investment in 2025 put pressure on profits in the short term, and this has had an impact on HRR as well.

However, this is by no means a result of disregarding HRR or its investors. Rather, Hoshino Resorts decided that it was time to invest in human resources in order to strengthen its future competitiveness and ensure the sustainable development of the tourism industry.

The relationship between Hoshino Resorts and HRR was established by separating what was originally one hotel business entity into two functions—ownership and operation. The essence of this relationship is not one in which one side wins. Rather, it is based on the idea of coexistence and prosperity that depends on both parties growing together.

As a result, Hoshino Resorts actively cooperated with us in promoting the aforementioned initiatives, which led to a recovery in investment unit prices.

Going forward, we will continue to combine Hoshino Resorts' strengths in hotel operations with our expertise as an asset management company in real estate management as we strive to sustainably increase the value of HRR.