The Japan Tourism Agency released its White Paper on Tourism in Japan, 2024 in May 2025. Many of the points were as expected, but some details differed from our forecasts. Reading this document gives us a view of the challenges recognized by the Japan Tourism Agency as well as the directions policies will take going forward. Here, I would like to share some of these and introduce Hoshino Resorts’ efforts while confirming the current tourism market in Japan.

Trends and Challenges in the Inbound Market

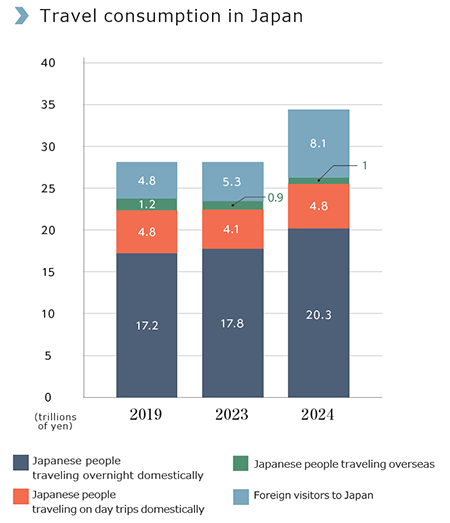

As has already been reported, the inbound market is up. In 2024, about 36.87 million foreign tourists visited Japan. This figure is not much higher than that seen in 2023, when the industry in Japan was recovering from the COVID pandemic. It is also a record high, exceeding the 31.88 million recorded in 2019 prior to the pandemic. The increase in inbound consumption exceeds the growth rate of the number of visitors. Inbound consumption was 4.8135 trillion yen in 2019, while it reached 8.1257 trillion yen in 2024. The composition of countries has also changed compared to before the COVID pandemic. Demand from countries like the US, Australia, France, Canada, and Germany has doubled, and excessive dependence on countries in Asia has decreased, indicating a positive trend.

While we can say this is the result of efforts made by Japan's tourism industry, I also believe that the depreciation of the yen contributed greatly to the figures seen in 2024. The challenge for 2025 and beyond is whether these figures can be made to grow steadily—even if it is not a rapid increase—in a continuous manner. And even if Japan achieves its target of 60 million foreign tourists at some point in the future, whether this number can be maintained and continued thereafter.

There is currently strong demand for the so-called Golden Route, a sightseeing route through Tokyo, Kyoto, and Hiroshima, but I feel the nature of this form of tourism makes it difficult to attract repeat visitors. Unless we create and enhance forms of tourism that will encourage inbound tourists to visit Japan repeatedly, we will not be able to maintain the market size when growth slows.

One form of tourism that has attracted repeat inbound tourists is snow-oriented tourism, particularly skiing and snowboarding. Hoshino Resorts operates Tomamu in Hokkaido, Nekoma Mountain in Fukushima Prefecture, and Mt. T in Gunma Prefecture. Each welcomes numerous repeat customers who visit almost every year. OMO7 Asahikawa, which has been generating demand in Asahikawa in the seven years since declaring itself a ski city, exceeded 95% occupancy in January and February 2025. During this period, 70% of the guests came to ski or snowboard, and about half of these were inbound visitors. We interview repeat guests to identify areas where we can improve, even if they are generally satisfied with their stay, and we aim to implement these improvements and let the guests know by the time the next season rolls around. The idea of creating a solid repeat market in inbound tourism will become increasingly important in the future.

In terms of accommodation, the top five prefectures, including Tokyo, Kyoto, and Osaka, were more concentrated than prior to the COVID pandemic in 2019. In order to create repeat inbound demand, it is necessary to strengthen not only cultural tourism, an area where Japan excels, but also nature-based tourism, an area where Japan has been relatively weak. There are 35 national parks in Japan, each home to diverse natural environments. Japan is also home to five World Natural Heritage sites. By strengthening tourism in these places, we can create occasions for people who have already been to Japan to visit again. Hoshino Resorts launched the “Lucy” mountain hotel brand in Japan with this in mind. We will open the first LUCY in Oze National Park in September 2025. There are over 300 mountain lodges in Japan, and these have their own solid fan bases. At the same time, there are many markets both domestically and internationally that cannot be targeted with the current styles of stays offered at typical Japanese mountain lodges. The LUCY brand will therefore work to develop new markets for mountain-oriented tourism in Japan.

Trends and Challenges in the Domestic Market

Domestic tourism by residents of Japan in 2024 reached a record high of 25.1 trillion yen, up from 21.9 trillion yen in the previous year. This was a huge increase, exceeding our own expectations.

According to figures from the Overnight Travel Statistics Survey, although the total number of Japanese guests was slightly lower than in 2023, travel spending increased due to a large increase in unit prices.

This year's White Paper on Tourism reaffirms the importance of domestic demand for the first time in a long time, and features a special report on the current situation and challenges. I have long emphasized the importance of domestic demand, which accounts for 73.4% of Japan's tourism consumption. So, I appreciate that the Japan Tourism Agency has examined domestic demand and referred to specific measures aimed at preserving the market.

One point I would like to highlight about domestic demand trends is the change in the composition ratio by purpose. Domestic business travel continues to experience a long-term decline, and domestic travel to return to family hometowns is also declining. With the adoption of online meetings, domestic travel for business purposes is expected to stagnate. The only increase is in overnight travel. When Hoshino Resorts entered the urban hotel market with the OMO brand in 2018, it chose to abandon the business market and focus on urban tourism demand, offering both tangible and intangible services to do so. For example, OMO7 Kochi, which opened in 2024, had a strong perception as being a business hotel before its rebranding. However, it succeeded in cultivating a new market by renovating to meet the needs of the urban tourism market and changing to the OMO brand. OMO confirmed the effectiveness of this brand strategy, expanding to 18 facilities nationwide, including the two newly announced locations. We hope to further increase market recognition of our OMO brand and expand into appealing cities across Japan.

Two Paradigm Shifts

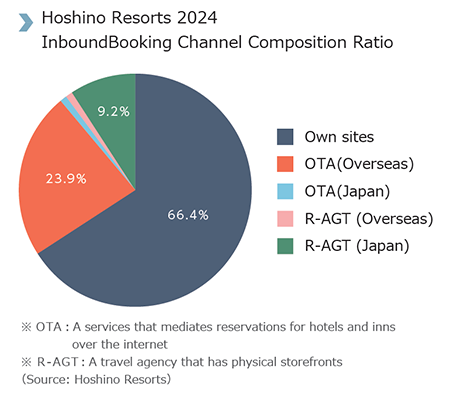

Hoshino Resorts is pursuing a strategy based on the belief that two major environmental changes will affect its competitiveness. First, domestic demand still accounts for the majority of the market, so attracting customers from this market remains the most important fact; however, the size of the inbound market has grown beyond our expectations, meaning we cannot remain competitive without the ability to attract inbound customers. Although most Hoshino Resorts facilities are located in regional tourist spots and regional cities, inbound tourism is expected to account for more than 28% of Hoshino Resorts ’ total transaction volume in 2025. It is worth noting that about 66% of inbound customers book directly with us.

Recognition of the Hoshino Resorts brand is lower overseas than in Japan.

But despite this, we have been able to maintain a high ratio of direct bookings because we have always positioned the ratio of direct bookings as the most important KPI and have built various systems in the course of promoting our inbound strategy over the long term since 2004. When travelers plan a visit to Japan, they seek out local information online before booking a hotel room. We have therefore created solid touchpoints at this stage and built a system to direct them to our websites. In order to prioritize direct bookings, we are actively narrowing down the channels of overseas online travel agents. Many of our facilities, including HOSHINOYA Kyoto and RISONARE Tomamu, have achieved a position where they do not contract with overseas online travel agents at all.

Another environmental change is the dawn of an era in which AI can help consumers make hotel reservations. Brand marketing is a marketing technique that exploits the limitations of the human brain. However, brands will be less influential with AI, which offers infinite memory and zero bias. So in this era, we believe that the ease of making reservations on our own website will be a great competitive advantage. Looking at booking sites in the tourism and accommodation industry, hotel rooms are still difficult to reserve. Adopting the 5-way positioning theory that "ease of access" is a competitive advantage, we have been researching and developing in this area for many years and, starting in the second half of 2025, will be rolling out new features to our booking sites over the next few years.

We believe this will not only increase our direct booking rate but will also contribute to increased demand for our own facilities as we see services become commoditized.