Sustainable Finance

Overview of the Green Finance Framework

HRR has formulated a Green Finance Framework as a basic policy for green finance, compliant with the Green Bond Principles and other principles and guidelines. The Japan Credit Rating Agency (JCR) has evaluated the appropriateness of the framework and assigned it JCR's highest rating, "Overall Evaluation: Green 1 (F)." Please see JCR's evaluation report below.

[JCR Green Finance Framework Evaluation Report]

HRR conducts, evaluates, and manages green financing based on this framework. It aims to provide ESG investment opportunities to a wide range of investors interested in sustainability.

1. Uses of procured funds

Green financing funds will be used in the acquisition of green buildings that meet the following eligibility criteria or the refinancing of green financing funds.

2. Eligibility criteria

This table can be scrolled sideways.

| (1) Green Building and Additional Initiatives contributing to the environment | Properties which have acquired or are scheduled to acquire certifications from third-party certification authorities by satisfying criteria ① to ④ below. If the additional initiatives specified in (i) to (v) are implemented for ① to ④, the entire property shall be considered a Green Eligible Property.

<Additional Initiatives>

|

|---|---|

| (2) Pollution Prevention and Management | Properties that have achieved a 100% recycling rate for waste. |

| (3) Energy Efficiency |

|

| (4) Renovation Works | ① Renovation works related to owned assets that enable beneficial environmental improvements, such as reductions in CO2, energy, water usage, or emissions (with a projected reduction in usage or emissions of 30% or more compared to traditional methods). ② Construction aimed at obtaining, renewing, or improving environmental certification by one level or more. |

| (5) Renewable energy | Acquisition or installation of renewable energy power generation facilities. |

3. Project evaluation and selection process

Projects that meet the eligibility criteria for the use of funds procured through green financing are selected by the Chief Sustainability Officer (CSuO) and are evaluated and discussed by the ESG Committee, which is composed of the President & CEO of the Asset Management Company, the Chief Investment Officer, the CFO, the Chief Strategy Officer (CSO), the Compliance Officer, and the CSO. Following these evaluations and discussions, projects are decided on by the Board of Directors of the Asset Management Company and reported to the Board of Directors of HRR.

- The names of departments and positions are listed according to the current company structure.

4. Management of procured funds

After funds are procured through green financing (interest rate derivative contracts associated with the loan, known as green derivatives) and deposited into an account, they are allocated without delay as funding for projects that meet the eligibility requirements or to refinance loans required to acquire projects which meet the eligibility requirements.

The Asset Management Company manages the allocation status of procured funds using internal electronic files and other media. It reports to its Board of Directors and HRR Board of Directors as necessary. Furthermore, internal audits are conducted by the Compliance Department and an audit corporation.

Procured funds that have yet to be allocated are managed in the form of cash or cash equivalents until their allocation. Even after all funds are allocated, if funds are no longer to be used for assets due to the sale or impairment, etc., of those assets before the redemption of the bonds subject to evaluation, the unallocated funds that temporarily arise are managed using portfolio management(*).

- Portfolio management is a management method used to confirm that the green finance balance during each accounting period does not exceed the maximum amount of green eligible liabilities [ total value of assets (acquisition price) for assets (properties) that satisfy green eligibility criteria (1) to (2)× LTV + total amount of money allocated to eligibility criteria (3) to (5)].

5. Reporting

(1) Reporting on the status of fund allocation

Each HRR accounting period, the following information is disclosed on its website.

- Any allocation plans for unallocated funds at the time of procurement through green financing

- If assets for which funds are to be used are sold before the redemption and repayment period, the fact that the balance is being managed using portfolio management, the green finance balance, and the maximum amount of green eligible liabilities

(2) Reporting on the effectiveness of environmental improvements

Every year, the following information is disclosed on HRR’s website only as applicable.

- Number and type of environmental certifications for acquisition assets

- Energy-saving effects from the replacement of air conditioning equipment, etc

- (For renovation work) Energy and water usage amounts before and after renovation

- (For renewable energy projects) Annual power generation and (estimated) CO2 reductions for the power generation equipment for which funds were allocated

- Annual power generated by EIMY (hydroelectric power, etc.)

- Amount of environmentally-friendly energy other than EIMY power that was procured

- Ongoing composting of food waste (from 2011)

- Reduction in amount of plastic container usage

- ① Ongoing switchover to use of pump bottles for shampoo, conditioner, and body soap (from 2019)

- ② Gradual switchover from mineral water in plastic drink bottles

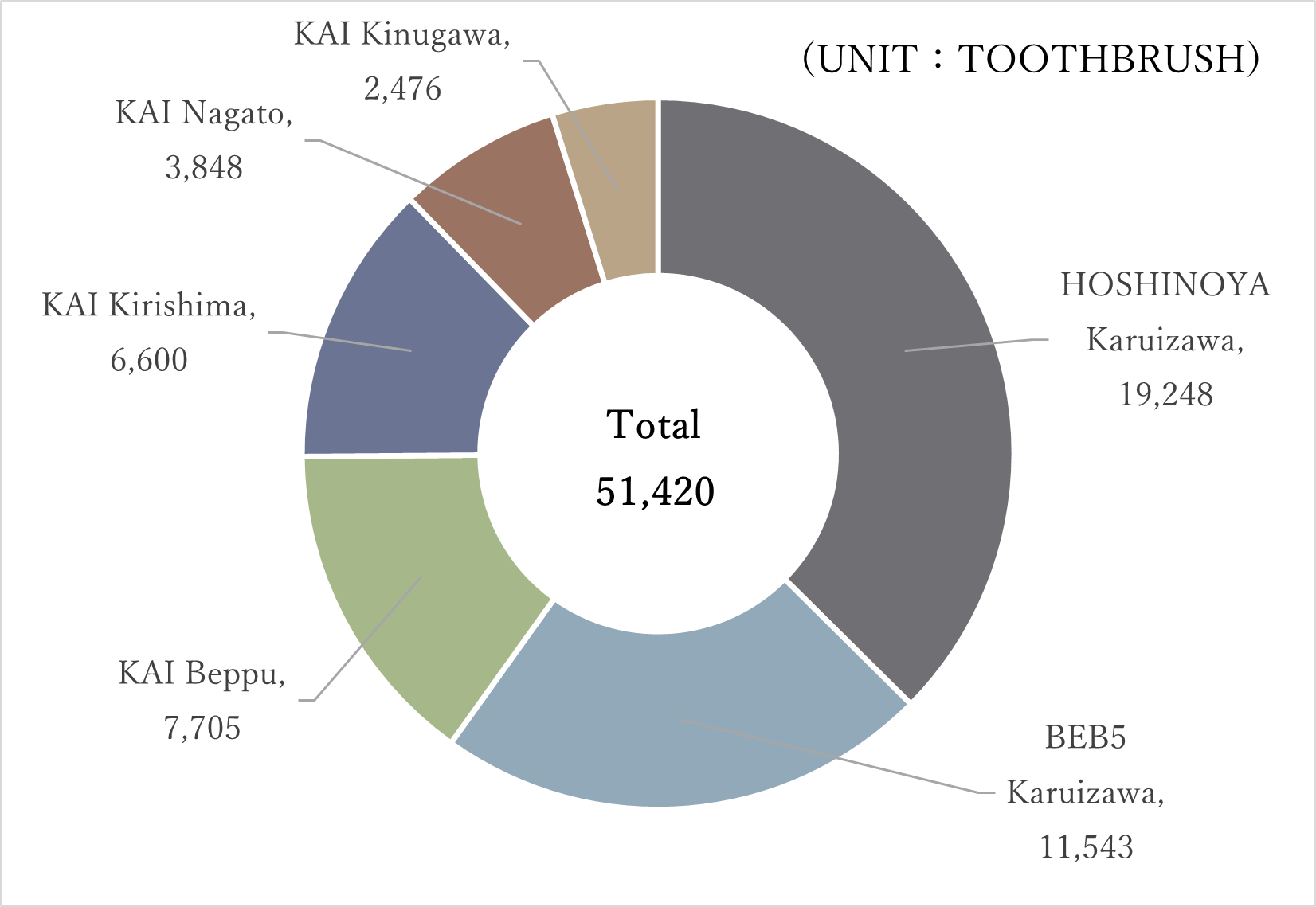

- Number of toothbrushes recycled

- Overview of Nature Conservation Activities

- Overview of Recycled waste

Reporting based on the Green Finance Framework

(1) List of green-qualified assets(as of November 28, 2025)

This table can be scrolled sideways.

| Green Building Certification (※1)(※2) | Property name | Acquisition Price (million yen)(※4) |

|

|---|---|---|---|

| CASBEE | BELS(※3) | ||

| S (★★★★★) |

- | HOSHINOYA Karuizawa | 7,600 |

| - | RISONARE Yatsugatake | 4,500 | |

| - | RISONARE Atami | 3,750 | |

| ★★ | ANA Crowne Plaza Hiroshima | 17,784 | |

| A (★★★★) |

★★★★ | KAI Alps | 3,060 |

| - | ★★★★★ | KAI Beppu | 7,335 |

| - | KAI Kirishima | 3,913 | |

| - | KAI Kinugawa | 3,080 | |

| - | KAI Nagato | 2,750 | |

| - | the b asakusa | 5,630 | |

| - | OMO7 Osaka | 29,000 | |

| - | ★★★★ | Candeo Hotels Sano | 1,260 |

| - | Comfort Inn Kofu Isawa(※5) | 658 | |

| - | Comfort Inn Munakata(※5) | 504 | |

| - | KAI Poroto | 3,060 | |

| - | ★★★ | Quintessa Hotel Osaka Shinsaibashi | 3,339 |

| - | Comfort Inn Ichinoseki IC(※5) | 700 | |

| - | HOTEL VISTA MATSUYAMA | 1,904 | |

| - | ★★ | BEB5 Karuizawa | 2,170 |

| - | - | Total | 101,997 |

- The scope of evaluation for BELS certification or CASBEE certification may be only for part of the property. However, the total acquisition price for each property is used as the acquisition price.

- In cases where multiple buildings within the property were granted BELS certification or CASBEE certification, the highest rating awarded to the relevant property is used.

- With the revision and enforcement of the notification for the Buildings Energy-efficiency Labelling system in April 2024, the energy conservation performance labelling has become a seven-step system, but the ratings here are based on the five steps under the previous system. Properties with 2 stars, except for BEB5 Karuizawa, which implements initiatives for 'pollution prevention and management,' will be excluded from the eligible criteria and will be removed when the repayment date for the existing sustainable finance loan is reached.

- Amounts are rounded down to the nearest unit.

- In regard to Comfort Inn properties, they are being sequentially rebranded from Chisun Inn since May 2, 2024, and the BELS ratings obtained at the time of Chisun Inn are shown.

(Reference)

Due to changes in the framework following the revision and enforcement of the notification for the Buildings Energy-efficiency Labelling system in April 2024, the properties listed below have been excluded from green-qualified assets.

| Green Building Certification (※1)(※2) | Property name | Acquisition Price (million yen)(※4) |

|

|---|---|---|---|

| CASBEE | BELS(※3) | ||

| - | ★★★ | HOSHINOYA Kyoto | 2,878 |

| - | ★★ | Comfort Hotel Takamatsu | 2,050 |

| - | Comfort Inn Chiba Hamano(※5) | 798 | |

| - | Candeo Hotels Fukuyama | 1,075 | |

| - | Candeo Hotels Chino | 793 | |

| - | Candeo Hotels Handa | 620 | |

| - | Candeo Hotels Kameyama | 470 | |

(2) Reporting on the status of fund allocation (As of November 28, 2025)

- There are no unallocated funds at the time of procurement through green finance.

- There has been no sale of assets that are subject to the use of funds.

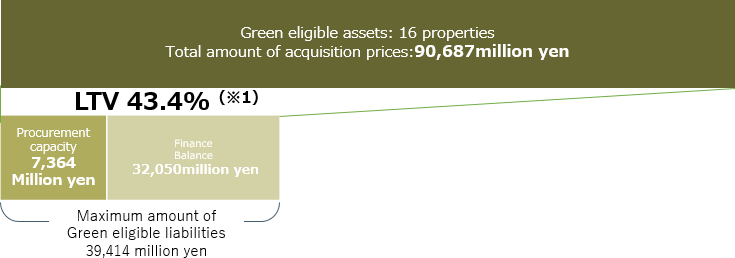

Green finance balance and maximum amount of green eligible liabilities (portfolio management)

- LTV is based on the ratio of interest-bearing liabilities as of May 1, 2025 to the total acquisition price of properties owned by HRR.

- Monetary amounts are rounded down to the nearest unit and ratios are rounded to the nearest unit.

| Maximum amount of green eligible liabilities (million yen) | Green finance balance (million yen) | |

|---|---|---|

| 45,803 | ≧ | 30,080 |

- The green finance balance does not exceed the maximum amount of green eligible liabilities.

(3) Reporting on environmental improvement results (as of May 1, 2025)

Information is disclosed only for properties owned by HRR that satisfy the eligibility criteria defined in the Green Finance Framework (green buildings), that are in the possession of HRR for the entire year, and for which data regarding individual reporting items can be collected.

Number and type of environmental certifications for acquisition assets

See the [External evaluations of sustainability] for details.

Energy-saving effects from the replacement of air conditioning equipment, etc

There are no funding procurements through green finance targeting the replacement of air conditioning equipment and other related systems.

(For renovation work) Energy and water usage amounts before and after the renovation work

There are no funding procurements through green finance targeting renovation work.

(For renovation work) Energy and water usage amounts before and after the renovation work was performed

To date, there has been no green finance fund procurement for renovation work.

(For renewable energy projects) Annual power generation and (estimated) CO2 reductions for the power generation equipment for which funds were allocated

To date, there has been no green finance fund procurement for renewable energy projects.

Annual power produced by EIMY (utilization of grand-source heat and hydroelectric power, etc.)

The amount of power produced annually by EIMY at HOSHINOYA Karuizawa is as follows.

(Unit: GJ=Gigajour)

This table can be scrolled sideways.

| Name of property | FY2024 |

|---|---|

| HOSHINOYA Karuizawa | 10,852 |

- The figure is the annual total from April to March of following year provided by Hoshino Resorts.

Amount of environmentally-friendly energy other than EIMY power that was procured

As of date, no environmentally-friendly energy other than EIMY power has been procured for properties other than HOSHINOYA Karuizawa.

Ongoing composting of food waste

The following properties are engaging in food waste composting on an ongoing basis.

Reduction of plastic container usage

① Ongoing switchover to use of pump bottles for shampoo, conditioner, and body soap

Pump bottles are being used for shampoo, conditioner, and body soap at the following 12 properties.

HOSHINOYA Karuizawa

KAI Kinugawa, KAI Nagato, KAI Kirishima and KAI Beppu

BEB5 Karuizawa

Comfort Inn Kofu Isawa, Comfort Inn Munakata

and Comfort Inn Ichinoseki IC

ANA Crowne Plaza Hiroshima

Candeo Hotels Sano

Quintessa Hotel Osaka Shinsaibashi

② Gradual switchover from mineral water in plastic bottles

In order to reduce their environmental impact, plastic bottles of mineral water are not being provided to guests at the following 10 properties.

HOSHINOYA Karuizawa

KAI Kinugawa, KAI Nagato, KAI Kirishima and KAI Beppu

BEB5 Karuizawa

Comfort Inn Kofu Isawa, Comfort Inn Munakata

and Comfort Inn Ichinoseki IC

Quintessa Hotel Osaka Shinsaibashi

Number of toothbrushes recycled

(FY2024 RESULTS OF TOOTHBRUSH RECYCLING)

- Figures are tabulated figures (approximate estimates) for one-year period from April of each year to March of the following year.

Overview of Nature Conservation Activities

Please refer to the following pages.

[Contribution to the local community and economy]

Overview of Recycled waste

There are no funding procurements through green finance targeting recycled waste.

Initiatives for recycled waste are being implemented at the properties listed below.

BEB5 Karuizawa